Apart from a few popular tech stocks, most U.S. stocks haven’t seen much growth in 2023. However, some Wall Street experts are still very optimistic.

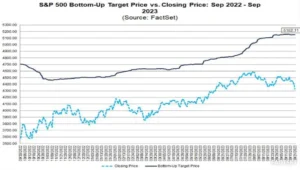

According to John Butters at FactSet, after analyzing their predictions for individual stock performance in the coming year, it seems that the S&P 500 index could increase by 19% from its level on September 21, when it closed at 4,330. If this happens, it would be the first time the S&P 500 crosses the 5,000 mark.

Butters mentioned, “On September 21, the projected target price for the S&P 500 was 5,152.11, which is 19.0% higher than its closing price of 4,330.00.”

Looking at different sectors, investors anticipate that the information technology sector will experience the most significant growth, with an expected increase of 22.8%. Consumer Discretionary comes next with a projected gain of 22.7%, followed by real estate, which is expected to see a 22.6% jump. On the flip side, analysts believe that energy stocks will have the smallest increase of just 10.7%, making it the sector with the least expected growth among the 11 sectors in the S&P 500.

The index’s anticipated performance relies on optimistic predictions of how much companies will earn, which is quite different from the earnings decline we’ve seen in the past three quarters.

According to experts on Wall Street, they anticipate that earnings will grow by 12.2% for the whole of 2024. It’s worth noting that this number was slightly lowered last week for the first time in over two months.

In the meantime, the estimated earnings for the third quarter have decreased by 0.2% since June 30. The average prediction for earnings has gone down from $55.86 to $55.74.

These S&P 500 forecasts are the combined predictions of various analysts who study individual company stocks. John Butters was able to identify the 10 stocks that Wall Street is most optimistic about and the 10 that are expected to underperform the rest of the index.

Here are some top-performing stocks to keep an eye on:

- SolarEdge Technologies, Inc. (SEDG) is expected to have a substantial gain of 112.8%.

- Insulet Corporation (PODD) is anticipated to see a gain of 75.1%.

- DexCom, Inc. (DXCM) is projected to grow by 68.4%.

- FMC Corporation (FMC) is expected to show a gain of 67.6%.

- United Airlines Holdings, Inc. (UAL) is forecasted to rise by 67.1%.

- Moderna, Inc. (MRNA) is estimated to increase by 66.6%.

- ResMed Inc. (RMD) is likely to experience a growth of 65.4%.

- Etsy, Inc. (ETSY) is expected to see a gain of 63.4%.

- Alaska Air Group, Inc. (ALK) is projected to grow by 62.5%.

- MGM Resorts International (MGM) is anticipated to have a gain of 60.7%.

Here are some stocks that have been trailing behind in terms of performance:

- Expeditors International of Washington, Inc. (EXPD) has shown a decrease of -5.3%.

- Tyson Foods, Inc. Class A (TSN) has seen a decline of -3.9%.

- Consolidated Edison, Inc. (ED) has experienced a drop of -3.1%.

- Robert Half Inc. (RHI) has had a decrease of -2.1%.

- Amgen Inc. (AMGN) has shown a decrease of -2.0%.

- Progressive Corporation (PGR) has seen a decline of -1.7%.

- International Business Machines Corp. (IBM) has had a decrease of -1.6%.

- Aon Plc Class A (AON) has experienced a slight dip of -0.9%.

- Seagate Technology Holdings PLC (STX) has shown a minor decrease of -0.7%.

- Cboe Global Markets Inc. (CBOE) has experienced a slight decline of -0.2%.

Since the beginning of August, U.S. stocks have been on a downward trend. The S&P 500 has dropped by 5.5% during this period. However, it’s important to note that the index is still up by 13% since the beginning of the year, as indicated by FactSet data. On Monday, it closed at 4,337.44 points.

Many experts attribute this stock market decline to the increase in Treasury yields, specifically the 10-year and 30-year bond yields. These rising yields are thought to be a major factor behind the recent selling of stocks.