On September 20th, the Federal Reserve decided not to raise interest rates, keeping them in the range of 5.25% to 5.50%. This decision came even though inflation heated up more than expected in August, surpassing the anticipated 3.6% by a slight 0.1% increase. However, the Fed’s preferred measure of inflation, known as core CPI, stayed in line with what experts from Dow Jones had predicted, at 4.3% over the year.

By keeping interest rates where they are, the Fed is essentially banking on the idea that the effects of previous rate hikes will eventually stabilize the economy. However, there’s a downside to this strategy – it might work too well and slow down the economy too much. Fed Chair Jerome Powell hinted at this possibility during a recent press conference when he said, “I’ve always thought that a smooth economic transition was a plausible outcome. Ultimately, the final outcome may depend on factors beyond our control, but I do believe it’s a possibility.”

Notably, Powell’s use of the word “possible” instead of “likely” is significant. In the past 40 years, there have been three instances of economic recessions in 1990, 2001, and 2007, where a smooth economic transition was hoped for but didn’t materialize. According to Fed Vice Chair Alan Blinder, there has been only one successful instance of such a smooth transition since World War II, which occurred in 1995.

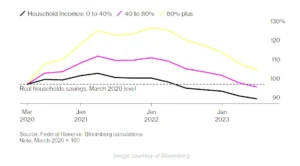

Furthermore, the idea of a gentle economic slowdown appears even more unlikely now, considering that household savings have dwindled. According to Bloomberg, the extra money saved by the majority of people, the bottom 80%, has returned to the same level it was at before the lockdowns started in March 2020.

The federal funds rate, which is the interest rate set by the central bank, had been very low, in the range of 0.00% to 0.25%, until a new round of rate increases began in March 2022. This sets the stage for the economy to potentially experience a harsh downturn. The big question is, how should investors approach this situation?

Should You Invest in Value Stocks Before a Severe Economic Downturn Occurs?

Among the various investment options out there, value stocks are the ones that require a more careful look, especially during the times when the stock market shifts from being really good to not so great. These stocks represent companies whose stock prices are lower than what experts think they should be, based on the company’s potential to make money and its underlying assets.

Value stocks, like Proctor & Gamble (PG) or Taiwan Semiconductor (TSM), are usually well-established and have strong financial foundations. Because they’re not highly valued, these types of stocks don’t have as far to fall if the economy takes a nosedive.

Another way to understand value investing is by considering market spreads. This year, there’s been a noticeable difference in how much various stocks are worth when you look at their price compared to how much money they’re making, known as their price-to-earnings (P/E) ratios.

In the first half of 2023, there was a lot of excitement about lower inflation and the buzz around artificial intelligence, and this excitement drove up the prices of biotech stocks. But now, it looks like the economic situation is about to change, and there’s a renewed interest in value stocks, as pointed out by Rob Arnott, the founder of Research Affiliates.

Arnott said in a Bloomberg interview, “It’s a great opportunity for those who’ve been riding the wave of growth stocks and haven’t focused much on value to rebalance their investments and take advantage of some good deals.”

The recent increase in the yield of the 10-year Treasury bond to 4.55% is the highest it’s been since October 2007. This suggests that the shift toward value stocks is on the horizon. Investors have picked up on the Federal Reserve’s message that interest rates will stay high for a while, and there’s a 40% chance of another rate hike by the end of the year.

In this economic climate, it’s seen as a smart move to invest in undervalued value stocks for the long term.