The announcement of a 3.2% increase in Social Security benefits aimed at helping with rising costs is good news, but it may not be enough to significantly ease the financial concerns of the 71 million Americans who rely on these monthly payments.

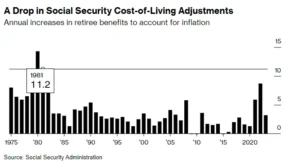

The 2024 adjustment, revealed on Wednesday, marks the third consecutive year of higher-than-usual increases. However, it falls far short of the 8.7% boost seen in 2023. On average, it translates to an extra $50 per month, raising the typical Social Security payment for retired individuals to $1,907 in the upcoming year.

While this increase won’t fully alleviate the financial strain caused by inflation, any rise in benefits is a positive step in helping individuals cope with rising living costs.

Mary Johnson, an analyst for Social Security and Medicare at the bipartisan Senior Citizens League, highlighted the significance of the cost-of-living adjustment for many retirees. She emphasized that, for a substantial portion of retirees, Social Security serves as their primary source of income, and this adjustment plays a crucial role in protecting them from the impact of rising prices. While it might not be as substantial as desired, it still provides a level of protection that many other forms of retirement income, such as 401(k) plans or pensions, do not offer.

A recent survey conducted by the Senior Citizens League, involving 2,258 members in September, discovered that 68% of respondents experienced household expenses that remained at least 10% higher than the previous year, even with the slowdown in the rate of inflation.

The yearly adjustment is determined by looking at how prices for common goods and services have changed. It specifically uses a measure called the Consumer Price Index for Wage Earners and Clerical Workers (CPI-W). They compare the average costs of things in the third quarter of 2023 to the same period in the previous year.

The impact of this inflation adjustment largely relies on the changes in Medicare Part B premiums, which are typically taken out of Social Security payments. Sometimes, when Medicare premiums increase, they offset any gains from the inflation adjustment.

In a report from March, the Medicare Trustees estimated that the standard Medicare Part B premium for 2024 would be $174.80, up from $164.90 the previous year. However, this estimation didn’t account for a new Alzheimer’s treatment, Leqembi, becoming part of Medicare coverage. According to the Senior Citizens League, this addition could mean an extra $5 per month in costs.

Challenges Loom as Social Security Faces Shortfall

The not-so-exciting Cost of Living Adjustment (COLA) is just one of the challenges retirees on Social Security are facing. The bigger issue is that the program is predicted to face a significant funding gap of around 23% by 2033.

This means that by that time, Social Security’s reserves will likely run out, and the money coming in from payroll taxes won’t be enough to cover all the current benefits. Social Security can’t borrow money to fill the gap, so changes will have to be made, or retirees may see a painful reduction in their benefits.

“In our surveys about retirement, there is a lot of concern about having enough income in retirement,” explained Johnson. “But the growing possibility of cuts to Social Security is becoming the number one worry.”

This makes it even more crucial to plan when to start receiving Social Security benefits. Claiming benefits as early as possible, at age 62, leads to a 30% reduction in the full benefits you could receive when you reach your full retirement age, which is typically around 67 for many workers.

According to a survey by Northwestern Mutual, nearly half of Americans (42%) can envision a future where Social Security doesn’t exist. The survey, which involved 2,740 participants, revealed that baby boomers anticipate Social Security covering 38% of their retirement expenses. In contrast, Gen Z, Millennials, and Gen X foresee it covering only 15%, 19%, and 27% of their retirement finances, respectively.