September is shaping up to be the toughest month for U.S. government debt returns in the past year. The continuous sell-off in long-term Treasurys is driving the 10-year and 30-year yields to levels not witnessed in over a decade. As yields climb, the prices of the bonds drop, which poses a challenge for those who already hold Treasurys.

In simpler terms, this means that if you’ve invested in U.S. government bonds, especially the long-term ones, their value has been decreasing significantly this month. This can be concerning for investors who were hoping to make money from these bonds or rely on them for steady returns.

The rise in yields, which reflects the interest rate on these bonds, can impact various financial markets and affect borrowing costs for both businesses and consumers. It’s a sign of shifting expectations about the economy and the Federal Reserve’s policies, and it’s closely watched by investors around the world.

With just two trading days left in the month (Thursday and Friday), things aren’t looking great for U.S. Treasury bonds. The Bloomberg U.S. Treasury Total Return Index, a tool bond traders use to gauge their performance, indicates that September is heading towards more significant losses compared to what we saw in February this year.

As of Thursday morning, this index shows a 2.5% decline for the month, slightly surpassing February’s 2.34% drop. It’s important to note that this index doesn’t directly reflect the changes in Treasury bond prices. Instead, it makes adjustments to standardize the results, providing a better picture of how U.S. government debt has performed throughout the month.

In simple terms, it means that investors who hold U.S. Treasury bonds may see more losses this month compared to earlier in the year. These losses can impact the overall bond market and have broader implications for the economy.

The decline in government debt this month has been relentless, particularly in the past week, following the Federal Reserve’s policy decision on September 20th. This trend suggests that investors are becoming more confident in the Fed’s message of keeping interest rates higher for an extended period, according to macro strategist Will Compernolle from FHN Financial in New York.

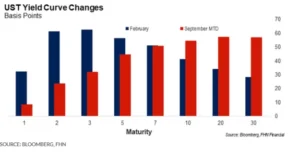

To understand this, let’s look back to February when there was a significant shift in expectations for the Federal Reserve’s actions. At that time, a strong nonfarm payrolls report and persistent inflation led traders and investors to anticipate the Fed would tighten its policies further.

Compernolle explained that in February, the weakness in Treasury bonds was mainly in the shorter end of the yield curve due to changing expectations about the Fed’s interest rates. Now, in September, the changes are occurring in the longer end of the yield curve, driven by the belief that the Fed will maintain higher interest rates for an extended period and concerns about inflation.

In essence, the recent selloff in government debt reflects the market’s response to evolving expectations about the Fed’s future actions, particularly regarding interest rates and inflation.

“When we speak with banks, they’re focused on maintaining stability and not increasing their holdings,” he explained. “They are operating in a challenging environment with narrow net-interest margins, where their main goal is to navigate until the Federal Reserve decides to reduce interest rates. There isn’t much room for them to take risks.”

On Thursday, the Treasury market saw a slowdown in its decline during the afternoon trading session in New York. Earlier in the day, the selloff had driven yields on 5 to 30-year Treasurys closer to the 5% mark. Meanwhile, all three major U.S. stock indexes – the Dow Jones Industrial Average (DJIA), the S&P 500 (SPX), and the Nasdaq Composite (COMP) – moved higher, with the Nasdaq Composite leading the way with a 1.2% gain.