Pakistan rupee is expected to perform the best of all currencies this month.” This remarkable rise is attributed to the government’s efforts to crack down on the illegal dollar trade, which has helped reverse the rupee’s fortunes.

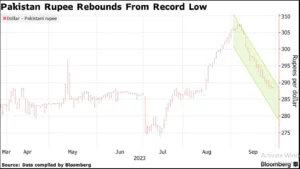

During September, the rupee saw an impressive surge of nearly 6%. This is particularly noteworthy because during the same period, most other currencies, including the Thai baht and the South Korean won, were weakening against the US dollar due to speculations that US interest rates would remain high for a longer duration.

On Thursday, the rupee experienced a slight increase of 0.1%, reaching a rate of 287.95 per dollar. This positive movement comes after a recent low point where it reached a record-low of approximately 307 earlier in the month. Please note that Pakistan’s currency market is closed for a public holiday on Friday.”

“According to Khurram Schehzad, the CEO of Alpha Beta Core Solutions Pvt. Ltd., a financial consultancy in Karachi, there were many instances of money leaks occurring through illegal channels like hawala and hundi trades in the open market. Hawala and hundi are informal methods of transferring funds commonly used in South Asia.

Schehzad explained, ‘When the value of the dollar starts to go down, various parties such as currency hoarders and exporters who have been holding onto their export earnings tend to sell their dollars.’

To combat these issues, Pakistan’s government has taken more aggressive steps, cracking down on individuals involved in the illicit dollar trade.

The Federal Investigation Agency carried out raids on various offices across the country, and undercover security personnel were stationed at currency exchange outlets to monitor dollar transactions. Prime Minister Anwaar-ul-Haq Kakar commented this week that the strengthening rupee is generating optimism for economic stability.”

The central bank has taken additional measures to enhance the transparency and oversight of the retail foreign exchange market. This includes increasing the capital requirements for smaller exchange companies and mandating large banks to establish their own exchange companies. These steps are aimed at making the retail foreign exchange market more transparent and easier to supervise.