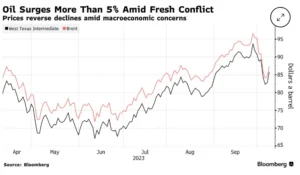

Oil price surge following a surprising attack by Hamas on Israel, sparking concerns about a broader conflict. In response, investors opted for safer assets like gold, bonds, and the dollar, steering clear of traditionally riskier options such as stocks.

West Texas Intermediate oil initially saw a more than 5% increase but later moderated its gains. The dollar’s strength index also rose by 0.3%, while US stock futures declined. In Europe, the Stoxx 600 index remained relatively stable, but energy and defense companies such as Shell Plc, BP Plc, BAE Systems Plc, and Saab AB saw their shares rise. Additionally, gold prices increased by 1%.

The Israeli shekel experienced a 2% depreciation, reaching its lowest point in seven years, despite the Bank of Israel’s introduction of an unprecedented support program for the markets. This program includes plans to sell up to $30 billion in foreign exchange and offer up to $15 billion through swap mechanisms to bolster market stability.

“This situation is a classic case of investors seeking safety,” commented Alexandre Baradez, chief market analyst at IG Markets in Paris. “When you consider the ongoing conflict alongside the economic uncertainties in Europe and China, the assertive stance of central banks, rising oil prices, and the approaching earnings season, it’s hard to see why markets would be on an upward trajectory.”

While the recent events do not pose an immediate threat to oil supplies, traders are worried that the conflict could escalate into a proxy war. The United States has announced the dispatch of warships, and the Wall Street Journal reported Iranian involvement in planning the attack.

Iran is not only a significant oil producer but also a supporter of Hamas. Any potential retaliation against Tehran could jeopardize the passage of ships through the vital Strait of Hormuz, a passage that Iran has previously threatened to block.

“The efforts to stabilize the situation don’t seem to be working well at the moment. That’s why we suggest a more cautious approach,” advised Christian Curac, a chartered financial analyst at Fuerst Fugger Privatbank. “The market is already experiencing an excessive sell-off, but it hasn’t reached a point where a technical rebound seems essential.”

Please note that US cash Treasuries trading is closed on Monday due to a public holiday.

In other news, Metro Bank saw its shares soar by over 20% as the struggling UK bank secured a £925 million ($1.1 billion) financing deal. This agreement involves a 40% reduction in the value of certain bonds held by investors and will result in Colombian financier Jaime Gilinski gaining a controlling stake in the bank.

This deal provides Metro Bank with some essential room to maneuver following a challenging week marked by sharp fluctuations in its stock price and the consulting firm EY approaching various lenders with potential offers.

Also read: Middle East Conflict Boosts Oil and Bonds, Drives Stock Market Decline