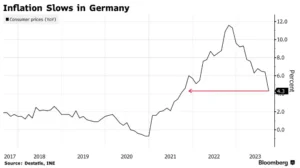

“German inflation has dropped to its lowest point in two years, primarily because the significant discounts on public transport from last summer are no longer part of the year-over-year comparison.

In September, consumer prices increased by 4.3% compared to the same month last year. This is a notable decrease from the 6.4% inflation rate recorded in August, as reported by the statistics office on Thursday.

Although this marks the slowest inflation rate since the surge in energy costs triggered by Russia’s invasion of Ukraine, it’s important to note that it’s still more than double the European Central Bank’s target of 2% for the entire 20-nation eurozone. Additionally, prices saw a 0.2% increase when compared on a month-to-month basis.”

The information coming from Europe’s largest economy reinforces the idea that the European Central Bank (ECB) will likely pause its series of interest rate hikes. They’ve already raised rates ten times in a row, which is unprecedented.

However, this doesn’t necessarily mean that a rate cut is imminent. ECB officials have indicated that they plan to keep interest rates relatively high for a significant period to help bring inflation back in line with their target.

Following this news, German bonds saw a reduction in their earlier losses, and the euro’s gains against other currencies became more modest. The market is increasingly accepting the idea that interest rates will remain elevated for an extended period. Currently, the yield on 10-year government bonds is just below 3%, the highest it’s been since 2011. The euro, in terms of its value against the US dollar, is approaching its weakest point this year, hovering near $1.05.

Money markets are currently predicting that by the end of 2024, there will likely be two quarter-point reductions in interest rates. This is a shift from the previous prediction of as many as three rate cuts just two weeks ago.

It’s worth noting that inflation remains high, and in some countries, it’s actually increasing. For instance, Spain recently reported a spike in inflation to 3.2% this month due to rising electricity and fuel prices. The central bank of Spain expects this trend to continue, with inflation possibly reaching 4.3% in 2024, largely due to the rising cost of oil, which is nearing $100 per barrel. Meanwhile, in Ireland, the rate of price growth accelerated from 4.9% to 5%.

One of the factors contributing to inflation concerns is the price of commodities, which could pose challenges to the European Central Bank’s goal of achieving 2% inflation in the euro area by the second half of 2025. Additionally, a separate report from the European Commission indicates that consumer expectations for inflation are at their highest level since May, further highlighting the complexity of the inflation landscape.

“As base effects and statistical biases that had driven the measure higher over the summer began to unwind, German HICP inflation fell in September. This provided evidence of diminishing underlying stresses. We expect this trend to persist in the coming months, offering policymakers at the ECB some reassurance over the medium-term inflation outlook.”

As the region’s economy falters, there are also risks on the downside. New predictions from five government-advising institutions predict that German output will decline by 0.6% this year, which is a more pessimistic outlook than that offered by the International Monetary Fund and the European Commission. The institutes see this year’s 6.1% inflation reading easing to 2.6% in 2024 and 1.9% in 2025.

The data for Germany in September indicates that inflationary pressures are easing, although part of this decline is influenced by the fact that the government had a special offer from June to August 2022 where you could get unlimited local and regional transport for just €9 ($9.48) a month.

However, it’s important not to become too complacent. Joachim Nagel, the President of the Bundesbank, has cautioned against prematurely assuming that everything is back to normal. He has mentioned that there might still be a need for additional interest rate hikes. As for the upcoming September figures for the entire euro area, which are expected to be released on Friday, they are anticipated to show a drop in inflation to 4.5% from 5.2%, the lowest it has been since late 2021.

Nagel stated in an interview on September 18, “We have already implemented 10 interest rate hikes, but it’s possible that more may be necessary if the data suggests that further actions are required.”