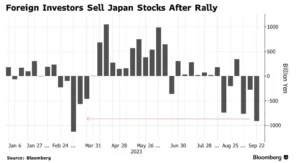

Foreign investors made the decision to sell a sizeable portion of Japanese stocks last week, which hadn’t happened since March. They sold a whopping ¥913 billion (equivalent to $6.1 billion), which is over three times the amount they sold the previous week.

This data comes from Japan Exchange Group Inc. and marks the largest net sales we’ve seen since the week ending March 10, when the global markets were rattled by the collapse of Silicon Valley Bank.

Japan’s Topix index experienced a 2.2% drop last week, and in the US, the S&P 500 Index lost 2.9%. This increased selling activity indicates that foreign investors are becoming more cautious, especially after making substantial ¥6.1 trillion in purchases in the previous quarter. The market has become more expensive following a strong rally, leading to this shift in sentiment among foreign investors.”

“A rise in US interest rates is causing a negative shift in investor sentiment,” explained Toshiya Matsunami, the chief analyst at Nissay Asset Management. “When US stocks are on the decline, foreign investors often opt to reduce their exposure to risk and cash in on assets that have performed well.”

Just earlier this month, the Topix index reached its highest point in 33 years, driven by hopes that inflation would make a comeback in the world’s third-largest economy, coupled with expectations of stronger economic growth. Additionally, the anticipation of governance reforms and the benefit of a weaker yen for exporters added to this positive outlook.

This surge in market performance has led to higher valuations for the Japanese market. The Topix index is now trading at 14.8 times expected earnings, which is at a premium compared to the MSCI Asia-Pacific index, currently at 13.3 times earnings. It’s worth noting that at the beginning of the year, the Topix had a lower valuation compared to the pan-Asian index.

The key takeaway here is that the increase in US interest rates is causing foreign investors to adopt a more cautious stance and take profits from their investments, particularly in assets that have been performing well. This has also had the effect of driving up valuations in the Japanese market, with the Topix now trading at a higher multiple than the broader Asia-Pacific index, which wasn’t the case at the start of the year.

When we consider futures contracts, foreign investors decided to sell a whopping ¥1.25 trillion worth of stocks, marking the largest weekly sell-off since March. On the flip side, Japanese individual investors went in a different direction, purchasing a net total of ¥661 billion worth of stocks, which represents their highest buying spree since late March.