Companies are being cautious about buying back their bonds at the moment, and this is happening at one of the slowest rates we’ve seen in a long time. It’s a sign that they might be waiting for the right moment to refinance their debt. However, this cautious approach could backfire as time goes on and interest rates remain high.

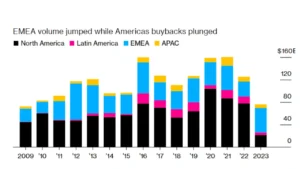

Globally, only about $76 billion worth of corporate bonds have been bought back this year, which is the lowest amount since 2009. It’s also a significant drop of 40% compared to the same period last year. In North America, there have been just 52 offers to repurchase outstanding debt, the lowest number since at least 2000. This translates to $22 billion repurchased, the lowest since at least 2008 and a 72% decrease from last year.

Bond buybacks are when companies repurchase their own debt through offers to bondholders, allowing them to pay off some or all of their debt before it’s due. Lately, companies are buying back less debt because interest rates have gone up considerably. Instead of selling new, more expensive bonds to buy back their existing debt, many companies prefer to hold onto their older, lower-interest debt for a longer period.”

“It’s quite striking to see how low the supply of credit has been in the market,” said Viktor Hjort, who leads the credit strategy and desk analysts at BNP Paribas SA. “When interest rates started to rise, companies were not in a hurry to refinance their debts. They thought, ‘Let’s wait and see if things get better.’ But now, we are getting closer to the deadlines when these debts are due.”

Because fewer companies are refinancing their short-term debts and turning them into longer-term obligations, the average maturity of bonds in both the US investment-grade and high-yield markets has been decreasing. In fact, it has reached an all-time low of just under five years according to Bloomberg’s US corporate high-yield bond index. “The average maturity of investment-grade bonds is around 11 years, which is close to the lowest point since 2018, based on data compiled by Bloomberg.”

Global Corporate Bond Buybacks at Lowest Levels Since 2009

“Only 16 tender offers have been made in the US market for lower-rated bonds this year, the fewest since at least 2000 and nearly 45% less”. This has resulted in about $4 billion worth of bonds being bought back, also the lowest amount we’ve seen in this century, and a significant 80% drop compared to last year.

Barbara Mariniello, who co-heads global debt capital markets at Barclays Plc, closely monitoring the investment-grade market, noted, ‘When it comes to managing our financial liabilities, this year has certainly been slower compared to the past, mainly because of the current interest rate environment.’

In the high-grade bond market, there were only 21 tender offers, the lowest since 2019 and a 40% decrease from the same period last year. This amounts to about $13 billion worth of high-grade bonds being repurchased, the lowest volume since at least 2014 and a substantial 71% decline compared to last year.

David Scott, who co-heads global debt advisory and capital solutions at BofA Securities, mentioned, ‘I don’t think anyone is in a hurry to refinance their low-interest bonds in today’s economic environment, unless they have no other choice.”

“According to BofA, the investment-grade bond market does not have a looming maturity wall like the high-yield bond market does. The bank’s credit strategists, led by Yuri Seliger, explained in a note on September 12 that this is because although investment-grade companies borrowed less in 2022, they had already taken advantage of historically low interest rates in 2021 to refinance their debts that were maturing in the future.

However, corporate borrowers are becoming increasingly aware that interest rates may remain high until at least 2024.

Oleg Melentyev, a credit strategist at BofA, noted in a September 15 note, ‘The maturity wall is now getting closer, and companies need to make decisions about how to manage their debt loads. Higher-quality companies will likely choose to reduce their debt because they have the financial strength to do so. On the other hand, lower-quality companies may not have other options but to reduce their debt as well.’

Experts from Barclays and Bank of America predict that we’ll see a resurgence in bond buybacks, one of the strategies that companies use to manage their liabilities. This strategy is getting more attention because the Federal Reserve’s aggressive interest rate hikes are signaling the end of the era of cheap money. In their recent meeting, Fed officials decided to keep the benchmark rate unchanged but indicated that another rate hike would happen in 2023, with less easing than expected in 2024.

Barbara Mariniello from Barclays notes, ‘Most people are realizing that interest rates will stay higher for a longer period, and they want to take care of their debt maturities. Waiting doesn’t seem like a smart move.’ However, she adds that larger companies with substantial liquidity sources may still choose to wait and see.

So, it’s a bit of a mixed picture. Some companies are eager to address their financing needs sooner rather than later, while others might hold off. It’s a decision of whether to wait and see or refinance to reduce risk.

Mariniello expects a significant increase in liability management activities when interest rates eventually decrease, possibly in the second half of 2024. She comments, ‘This could be the calm before the storm, but it’s a matter of when exactly that storm will arrive. We anticipate more debt tenders before the end of this year, but the real increase in activity might be more of a 2024 story.’

Many bonds in the US investment-grade market are currently trading below their face value, which provides an incentive for companies to buy them back at a discounted price.

Bank of America also anticipates an uptick in liability management activities. They’ve been involved in 63 such deals this year, closely trailing Citigroup Inc. with 64 deals and JP Morgan Chase & Co. at the top with 73 deals, according to Bloomberg-compiled data.”

Anticipating a Recovery

“In the coming five years, discussions with companies issuing debt will likely revolve around managing the amount of debt they have maturing in each year,” predicts David Scott from BofA. He suggests that with the looming challenges many face in 2024 and beyond, it would be wise to start reducing the risk of refinancing, even if it means accepting slightly higher interest rates compared to the historically low rates of the past decade.

Scott adds, ‘We’ll probably see higher volumes and more companies looking to address their refinancing needs sooner. However, the timing of these actions will depend on various factors like changes in interest rates and decisions made by the Federal Reserve.’

The situation in Europe, the Middle East, and Africa is notably different. The region has witnessed 110 tender offers since the beginning of this year, marking a nearly 62% increase from the previous year. This is also the highest number of tender offers seen since at least 2012, resulting in a total repurchase volume of $43 billion, the most since at least 2016.

In contrast, the Asia-Pacific region experienced around $6.5 billion in repurchases, a 24% drop compared to the previous year and the lowest since at least 2019. Similarly, Latin America saw approximately $4.5 billion in repurchases, down by 63% year-over-year, and the lowest since at least 2015.”