Argentina’s financial markets are facing uncertainty due to an upcoming presidential election. The outcome is unpredictable, and there’s a possibility that a libertarian candidate with radical ideas could win. Investors are uncertain about how to react to this candidate, as they are unsure whether they should support or be cautious about their policies.

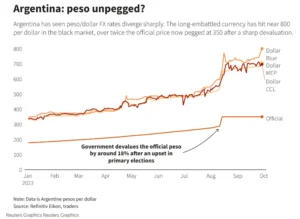

As the October 22 election approaches, bond prices are falling, and the peso has weakened significantly, reaching a record value of 800 pesos per US dollar on the unofficial black market. This unofficial rate is considered a more accurate reflection of the peso’s actual value, as the official exchange rate is influenced by capital controls and does not represent the true economic situation.

Roberto Geretto, an economist at the local investment fund Fundcorp, explained the recent changes in Argentina’s financial landscape by saying, “The dollar surpassing 800 pesos and bond prices falling are signs of investors protecting themselves. What was initially an election strategy has now turned into concerns about the election.”

The upcoming election has put outsider Javier Milei in the spotlight. He has proposed some market-friendly ideas like significant spending reductions and adopting the dollar as the official currency. However, Milei is considered an unpredictable and unfamiliar figure in the political arena. He has also expressed intentions to close down the central bank.

Javier Milei’s main competitors in the election are Sergio Massa, the economy chief of the current center-left coalition in power, and Patricia Bullrich, a conservative former security minister. Milei is currently ahead in the polls, but experts anticipate that there will likely be a second-round runoff election, although they acknowledge that anything could happen.

In order to secure an outright victory in the election, a candidate needs to obtain either 45% of the vote or 40% with a 10-point lead over the second-place candidate. If no candidate achieves this, a head-to-head runoff election will be held on November 19 to determine Argentina’s next president.

The upcoming election is adding to the economic troubles in Argentina, which were already quite complicated due to years of poor financial management, extensive budget shortfalls, and increasing debt. Inflation is soaring at an annual rate of 124%, the central bank’s reserves are in the negative, and the government had to devalue the peso by 20% in August.

The poverty rate, which measures households living on less than approximately $215 per month in and around Buenos Aires (with different thresholds in other parts of the country), has exceeded 40%. Additionally, interest rates have climbed to 118%, making it difficult to access credit.

GMA Capital explained the situation as a “perfect storm” caused by global economic instability, election-driven policies that aim to boost demand but result in a larger deficit and more money printing, and the general uncertainty surrounding the upcoming elections.

Argentina’s government bonds, which were already in a tough spot due to a significant default and restructuring in recent years, experienced a more than 10% drop last week, especially the bonds denominated in the local currency. This decline continued on Monday.

Investors are anticipating another devaluation of the peso after the election, which is putting pressure on the currency and prompting many to convert their holdings into dollars. The unofficial exchange rate is significantly higher than the official rate of 350 pesos per dollar, exceeding 100% difference.

Mauro Natalucci from the local brokerage Rava Bursátil explained, “With the general elections less than a month away, the local market seems to be getting weaker because people expect a big increase in the exchange rate.”

People are making bets that the peso is going to lose value soon. In December, these bets indicate that people expect the exchange rate to be around 682 pesos per dollar, and by May 2024, they’re expecting it to be as high as 1,058 pesos per dollar.

Economist Gustavo Ber explained, “Given the current atmosphere of uncertainty in politics and the economy, more and more people are choosing to use the dollar, especially with the elections approaching and concerns about the political future growing. Some of these concerns include the possibility of another devaluation happening in a situation where inflation is already quite high.”

(Note: The exchange rate mentioned is $1 = 349.9500 Argentine pesos)