The crypto Market is still recovering from the dramatic downfall of FTX and other major players last year. Prices, trading volumes, and venture capital investments in cryptocurrencies are significantly lower than their 2021 highs.

Sam Bankman-Fried, the former CEO of FTX, is currently on trial in New York, facing seven charges of fraud and conspiracy related to the sudden collapse of the exchange in November 2022. He has entered a not guilty plea.

FTX was just one of the many problems in the cryptocurrency world that caused the price of bitcoin to drop to its lowest point since 2020. While bitcoin and other popular cryptocurrencies have bounced back somewhat, the overall cryptocurrency market is still not as exciting as it was in late 2021.

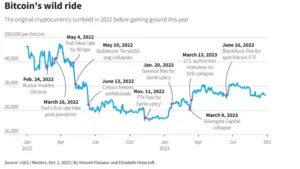

BITCOIN DOWNTURN?

Bitcoin, the largest cryptocurrency and a key indicator of the crypto market, has rebounded by approximately 37% since November 1st.

In 2021, Bitcoin reached an all-time high of $69,000 in November. However, when central banks began raising interest rates early in 2022, riskier assets like cryptocurrencies faced challenges as investors sought better returns elsewhere.

Bitcoin’s value plummeted by over 65% last year, largely due to the collapse of the stablecoin terraUSD. This event prompted Singapore hedge fund Three Arrows Capital to declare bankruptcy and had broader repercussions in the crypto markets.

The failure of FTX furthered Bitcoin’s slide, bringing it below $16,000 in November. Another blow came when Silvergate Bank, a popular partner for U.S. crypto companies, announced its closure earlier this year.

Nevertheless, Bitcoin has made a significant recovery this year, thanks to the interest of major financial institutions like BlackRock and optimism that interest rate hikes are slowing down. As of Monday, it was trading at around $28,089.

Ben Laidler, global markets strategist at eToro, commented, “The FTX debacle came at the end of a challenging year that had already seen a tech sector downturn, rising interest rates, and self-inflicted setbacks within the industry.”

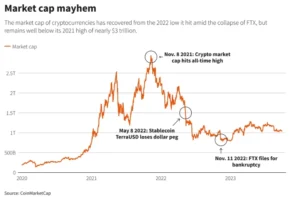

DECLINING MARKET CAP

The total cryptocurrency market value reached its peak at $3 trillion in November 2021. However, it experienced a significant drop throughout 2022, hitting a low point of $796 billion due to the FTX collapse. Since then, it has made a partial recovery, remaining above $1 trillion for most of this year.

Usman Ahmad, the CEO of Zodia Markets, Standard Chartered’s crypto exchange, commented, “The issues with FTX have undoubtedly affected confidence in the broader crypto ecosystem.

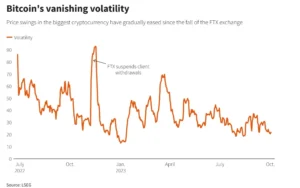

STABILIZING BITCOIN?

Bitcoin, known for its wild price swings, has shown more stability this year. However, some experts believe that this relative calm in the cryptocurrency market isn’t necessarily positive.

They point out that many investors are drawn to crypto due to its volatility, which provides chances for fast gains. Anders Kvamme Jensen, founder of AKJ, a crypto company, predicts that we can anticipate lower to moderate volatility in the short term.

VC CRYPTO INVESTMENTS DECLINE

Venture capital (VC) funding poured into the cryptocurrency industry during its explosive growth in 2021 and continued into 2022. However, such investments have significantly slowed down in 2023 as many firms suffered losses during the market downturn.

In the first quarter of 2022, VC investments in cryptocurrencies in the United States reached $6.12 billion, but they dropped to just $870 million in the same quarter this year, according to data from PitchBook.

“This decline wasn’t solely due to FTX’s troubles but had already started with the collapse of the [terraUSD] ecosystem earlier in the year,” explained Robert Le, a senior cryptocurrency analyst at Pitchbook.

“Venture investors are now proceeding cautiously,” he added.

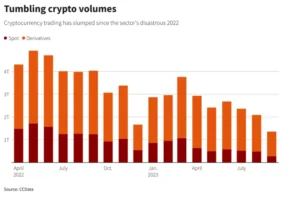

VANISHING VOLUMES

Following FTX’s collapse, cryptocurrency trading activity has taken a nosedive. This decline has prompted traders, who were once drawn to the market’s liquidity, to either pause their trading activities or exit the market entirely.

In September 2023, total monthly trading volumes for both spot and derivative markets plunged to $1.4 trillion, marking a drop of over 60% compared to September 2022, as reported by London-based research firm CCData. Spot markets were hit the hardest, with trading volumes plummeting by over 70% to $272 billion.

Derivative trading volumes have also seen a significant decline, down by 60% to $1.1 trillion over the past 12 months since September 2022.

“The departure of major market makers after the FTX incident significantly reduced liquidity, resulting in both decreased trading volumes and decreased price volatility,” explained Noelle Acheson, an economist closely monitoring the cryptocurrency market.