British stocks finished the last quarter of September on a positive note. Mid-cap stocks, focused on the UK market, rebounded after six days of losses. New data revealed that the UK’s economy performed better in the second quarter than initially estimated.

The FTSE 100 index closed slightly higher, marking a 1% gain for the entire third quarter following a 1.3% drop in the previous quarter. However, it is worth noting that the index is currently experiencing its second consecutive weekly decline. This brings its year-to-date gains to 2.1%, which lags behind the broader European STOXX 600 index’s impressive 6% rise this year.

“Considering how the FTSE 100 has struggled for most of this year, it seems that any potential downside may not be significant in the current situation,” said Michael Hewson, chief market analyst at CMC Markets”.

In contrast, the mid-cap FTSE 250 index made a significant 1.0% leap.

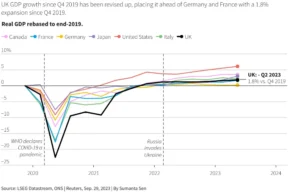

The latest data reveals that the UK’s GDP in the second quarter was 1.8% larger than it was in the final three months of 2019, the period before the COVID-19 pandemic began. This marks a substantial upward revision from the previous estimate and indicates faster growth compared to Germany and France.

“The UK economy is doing surprisingly well, and consumers seem to be holding up better than expected. This might lead to another interest rate increase by the end of the year, and we could see higher interest rates for an extended period,” explained Anthi Tsouvali, a multi-asset strategist at State Street Global Markets.

Traders are currently estimating a 67% probability that the Bank of England will refrain from making any changes at its November meeting, following the unexpected decision to keep rates steady at 5.25% last week.

The top-performing sectors were chemicals, surging by 3.1%, and real estate, with a 2.5% increase. However, shares in oil and gas companies didn’t fare as well.

In terms of individual stocks, Aston Martin saw a significant rise of 9.5%. This boost came after the luxury carmaker announced that Chairman Lawrence Stroll’s Yew Tree Consortium had increased its stake in the company.

Severn Trent, a British water supplier, also saw gains of 4.4% as it revealed plans to raise £1 billion ($1.2 billion) through new equity.

On a different note, data indicated that British mortgage approvals hit a six-month low in Augus