In August, orders placed with US factories for business equipment made a strong comeback. This suggests that businesses are continuing to invest in spite of higher borrowing costs.

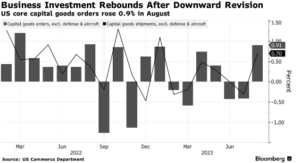

The value of orders for core capital goods, which is a way to measure investments in equipment (excluding aircraft and military items), increased by 0.9% last month. This rebound came after a revised 0.4% decrease in July and marks the most significant increase since the beginning of the year.

Additionally, orders for all durable goods, which are products designed to last for at least three years, went up by 0.2%. This improvement comes after a previous reading that was revised downward. If we exclude orders for transportation equipment, there was still a solid 0.4% increase. It’s important to note that these numbers are not adjusted for inflation.

The rise in orders was driven by increased demand for computers, electrical equipment, and machinery. Additionally, there was a significant 19% surge in orders for military aircraft.

This report suggests that businesses are still committed to making long-term improvements, even in the face of higher borrowing costs and economic uncertainty. While the pace of investment has slowed somewhat, companies are now benefiting from reduced inflation and more stable supply chains.

Furthermore, shipments of core capital goods, which play a role in calculating equipment investment for the government’s GDP report, saw a robust increase of 0.7%. This is the most substantial rise since the beginning of the year. The initial estimate for third-quarter GDP will be released in late October, but there might be delays if a government shutdown occurs, as it is likely.

Both Wall Street experts and economists at the Federal Reserve are becoming more positive about the economy’s short-term outlook. According to a survey by Bloomberg, forecasters now expect the GDP to grow by 3% in the third quarter, which is a more optimistic projection compared to last month. One of the reasons for this improvement is stronger private investment.

In the recent report from the Commerce Department, there was a noticeable drop in orders for commercial aircraft. These numbers can be quite erratic from one month to another, and they fell by approximately 16%, following a slump in July.

For instance, Boeing Co. reported only 45 orders in August, which is the lowest figure since April. It’s worth noting that aircraft orders can be quite unpredictable, and the data provided by the government doesn’t always align with the monthly figures reported by aircraft manufacturers.

Even though manufacturing has been struggling for nearly two years, the rate of decline has begun to slow down. However, there’s a significant challenge on the horizon: a massive strike affecting the three biggest US automakers. This strike, which is now in its second week, has the potential to hamper the manufacturing sector just when supply chains and prices were starting to stabilize.