In September, US Consumer Prices went up, especially due to a surprising rise in rental costs. However, there’s a steady decrease in the overall inflation pressure, which is making people believe that the Federal Reserve won’t increase interest rates in the upcoming month.

The report, released by the Labor Department, also indicated that the yearly increase in consumer prices, excluding the unpredictable food and energy costs, was the smallest it has been in the past two years.

Economists thought the sudden increase in rents, even though there’s more apartment buildings available and rent prices were seen as dropping in surveys, would probably go back down in the near future. Still, because the job market is quite competitive, it might take a while for the Federal Reserve to reach its 2% inflation goal. So, it’s possible that the Fed will keep interest rates higher for a longer time.

Additionally, the rise in U.S. Treasury bond yields and tensions in the Middle East are likely to make the Federal Reserve hesitant to make monetary policy stricter.

Gasoline prices went up by 2.1%, following a significant 10.6% increase in August. Food prices also increased by 0.2% for the third consecutive month.

When we look at groceries, food prices inched up by 0.1%. People paid more for meat, fish, and eggs, but the prices of cereals and bakery products went down for the first time since June 2021. Prices for fruits, vegetables, and nonalcoholic beverages remained the same.

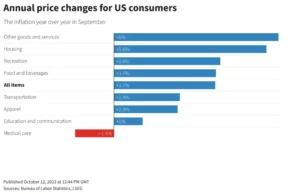

Over the last 12 months until September, the Consumer Price Index (CPI) increased by 3.7%, following the same pattern as in August. It’s important to note that the year-on-year consumer prices have come down from a peak of 9.1% in June 2022. Economists who were surveyed by Reuters had predicted a 0.3% increase in the CPI for the month and a 3.6% increase on a year-on-year basis.

If we don’t count the unpredictable food and energy costs, the Consumer Price Index (CPI) increased by 0.3%, which is the same as the gain in August. There was a significant 0.6% increase in owners’ equivalent rent, which measures how much homeowners could charge for renting their property or what they would pay to rent it.

This 0.6% increase is the largest we’ve seen since February and comes after a 0.4% gain in August. However, it’s important to note that other independent measurements still show that rents have been going down. Usually, the rent data in the CPI takes a few months to catch up with the trends seen in these independent measures.

Stephen Juneau, a U.S. economist at Bank of America Securities in New York, said, “We need to see more data to figure out if this is just a temporary change or if there’s something more fundamental happening. It could be that rents are increasing more in big cities while going up more slowly in smaller ones.”

The “core CPI,” which excludes some volatile items, was pushed up by a 3.7% increase in the cost of staying in places like hotels and lodging away from home. This ended three months of declining prices. There were also increases in the costs of things like motor vehicle insurance, recreation, personal care, new cars, and items related to household furnishings and operations.

However, prices for used cars and trucks went down by 2.5%, and clothing costs dropped by 0.8%. Looking at the core CPI on a year-on-year basis, it increased by 4.1% in September, which is the smallest rise since September 2021, following a 4.3% increase in August. Over the past three months, the core CPI went up by 3.1%.

Rising rents led to a 0.6% increase in inflation for services, excluding energy costs, while the prices of used cars and trucks falling extended the decrease in prices for core goods, which went down by 0.4%.

On Wall Street, stocks were trading with higher values. The value of the U.S. dollar rose compared to a basket of other currencies, and U.S. Treasury bond prices decreased.

A Competitive Job Market

The continued strong demand in the economy, highlighted by a competitive job market, is causing inflation in core services, excluding rents, to rise. This suggests that the higher interest rates might stick around for a while. In a different report, the Labor Department mentioned that the number of people filing for state unemployment benefits remained the same at 209,000 for the week ending on October 7th.

So far, there’s no clear sign that the ongoing United Auto Workers (UAW) strike, which is now in its fourth week, is significantly affecting the job market. However, this strike is causing problems in the supply chain, which has led Ford, General Motors, and Chrysler’s parent company, Stellantis, to temporarily lay off many workers.

The UAW strike has been identified by Federal Reserve policymakers as a new source of uncertainty when looking at the economic outlook. The minutes of the Fed’s meeting held on September 19-20, which were published recently, mentioned that “many participants observed that an intensification of the strike posed both an upside risk to inflation and a downside risk to activity.”

In the latest report, it was noted that the number of people receiving benefits after the first week of assistance, which is an indicator of hiring, went up by 30,000 to reach 1.702 million during the week ending on September 30. While inflation is gradually decreasing, the strong job market still makes the threat of rising inflation something the Federal Reserve needs to consider carefully.

Seema Shah, chief global strategist at Principal Asset Management, commented on this by saying,”Indeed, while inflation is slowly edging lower, the strong labor market means that the threat of inflation resurgence cannot be ignored, keeping the Fed on its toes.”