On Wednesday, there was a significant sell-off in government Global Bond. This caused the interest rate on U.S. 30-year Treasury bonds to briefly reach 5%, which hasn’t happened since 2007. Additionally, German 10-year bond yields hit 3%. These movements in bond yields could potentially lead to a global economic slowdown and negatively impact both stocks and corporate bonds.

However, as the day went on, the bond market calmed down, and yields started to decrease. Nevertheless, given the consistently strong economic data in the United States, a sudden reversal of traders’ bets on a bond market rally, and an increase in the supply of bonds, there’s a growing belief that interest rates in major economies will remain elevated for a longer time as a measure to control inflation.

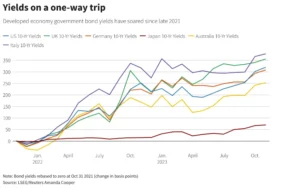

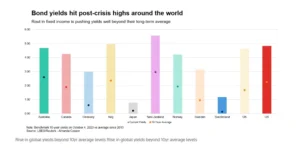

In the U.S. Treasury market, which is essentially the foundation of the global financial system, the yields on 10-year government bonds have surged by as much as 20 basis points (0.2%) in just this week, reaching 4.8%. Over the course of this year, they’ve risen by nearly 100 basis points, and in 2022, they saw an even more substantial increase of over 200 basis points.

It’s important to know that when bond yields go up, bond prices go down. Many asset managers who had been holding onto bonds, expecting their prices to go up, are now giving up on that expectation.

Juan Valenzuela, a fixed income portfolio manager at the asset management company Artemis, explained, “At the moment, there’s a strong trend of selling off Treasury bonds because many investors had positioned themselves in a way that turned out to be wrong.”

On Wednesday, the interest rates on 30-year U.S. government bonds reached 5% for the first time since the global financial crisis. This marked a significant moment in the bond market. In Germany, the yield on their 10-year government bonds also reached 3%, which is noteworthy because not too long ago, yields in that market were actually negative in early 2022.

However, the interest rates on 30-year U.S. bonds later dropped and were recently at 4.86%. This drop came after the release of the ADP National Employment Report, which showed that job growth in the private sector of the United States was much lower than what was expected for the month of September.

Australian and Canadian 10-year government bond yields have risen by more than 20 basis points (0.2%) each just this week. Meanwhile, the yields on British 30-year government bonds reached a new high, surpassing 5% for the first time in 25 years.

To show how uneasy investors are, the widely-watched MOVE bond volatility index has hit a four-month high, indicating increased nervousness in the bond market.

Another factor affecting bond prices is the increase in the supply of bonds. Governments are issuing more debt to cover budget deficits and are also selling off large bond holdings they accumulated during recent crises.

There’s also concern related to the political situation in the United States. Just recently, a group of Republicans in the U.S. House of Representatives removed Republican Speaker Kevin McCarthy from his position, shortly after narrowly avoiding a government shutdown.

Michael Metcalfe, who leads global macro strategy at State Street Global Markets in London, pointed out that the recent decline in Treasury prices suggests that there’s now an added element of political uncertainty affecting the market.

The interest rates that governments have to pay on their loans impact many aspects of our lives, from the rates on our mortgages to the rates that companies pay for loans.

The sudden rise in these interest rates has caused concern in the stock market and has led to the U.S. dollar strengthening against the euro, pound, and Japanese yen.

Global stocks hit their lowest point since April, and the cost of insuring against risky European corporate bonds reached a five-month high.

The S&P 500 index was up slightly on Wednesday, but many experts are feeling cautious about investing in risky assets right now.

Vikram Aggarwal, a sovereign bond fund manager at Jupiter, explained that risky assets like stocks and corporate bonds are vulnerable to a possible economic downturn caused by central banks raising interest rates. On the other hand, if there’s no recession and interest rates remain high, that could also be detrimental to risky assets.

For central banks, the challenge is to decide whether they should raise rates to control inflation or keep them low to support the economy, and the recent increase in borrowing costs adds complexity to their decision-making.

The uncertainty about when and how the economy might worsen is making things more complicated in the bond market. This uncertainty is causing a stronger sell-off in bonds with longer maturity dates.

The 10-year U.S. term premium, which is a measure of how much extra compensation investors want for lending money for a longer time, has become positive for the first time since June 2021. It has also gone up by more than 70 basis points since the end of August, as reported by the New York Federal Reserve.

Richard McGuire, who is the head of rates strategy at Rabobank, explained, “Many people have been predicting a recession that just hasn’t happened. On top of that, we’re seeing oil prices go up, which is making it more complicated to predict what central banks will do with interest rates. All of this is making investors cautious about locking their money into longer-term government bonds. They want extra compensation for that.”